Pricing. After Tesla’s Semi and Roadster event on November 16th, we speculated that the Semi would cost $250k, which turned out to be far too high a estimate. Tesla’s Semi with a range of 300 miles will cost $150k, and the 500-mile range option will cost $180k. Tesla is also accepting 1000 reservations for the $200k ‘Founders Series’ Semi, requiring customers to pay in full up-front. These prices are “expected base prices,” so we anticipate an ASP of $180k, which is a positive for gaining the widespread adoption necessary to disrupt an industry.

Cash flow from preorders. Over the past week and a half, preorders for the Semi have been rolling in from some of North America’s largest logistics providers. Tesla has not provided any info on how many deposits they have accepted, but so far, six different companies were excited enough to announce them (more below). Excluding a Founders Series purchase ($200k), a reservation requires a $20k payment. The cash flow from these reservations is a unique way for Tesla to raise funds as they face Model 3 production issues and ambitious plans around charging infrastructure and energy storage. If they sell out the Founders Series Semi preorders (1,000 available), they will raise $200M. Coupled with 1000 available $250k Roadster reservations ($250M potential), Tesla stands to raise $450M – nearly double the $226.1M raised in their 2010 IPO. While some investors may view this as more smoke and mirrors, we argue that it is a scrappy and creative way for a company that is pushing the envelope to thrive under adversity. We believe in Tesla’s mission and recognize that achieving uncommon results sometimes requires uncommon methodology.

Here are some of the companies that have reserved Semis so far:

Walmart has ordered 15 trucks – 5 to be used in the U.S. and 10 in Canada. Walmart has experimented with new trucking technology in the past, and is calling this early adoption a test. Tesla hopes order volume will increase if the trucks prove to decrease cost of operation. Walmart operates a network of about 6,000 tractors, so 15 will have little impact on the fleet. Walmart’s operations, however, are the Tesla Semi’s bread and butter – the average distribution center services 90-100 stores within a 200-mile radius, so the truck can conceivably make a delivery and return to the facility on a single charge.

J.B. Hunt, one of the country’s leading carriers, said it has reserved, “multiple” tractors to be used on the west coast. CEO John Roberts adds, “Reserving Tesla trucks marks an important step in our efforts to implement industry-changing technology.” Their fleet is much larger than Walmart’s, at 15,000 vehicles, so “multiple” may mean more than a few.

Meijer, a supermarket chain based in Michigan, has placed orders for 4 trucks and called it a “small financial commitment” to test new truck technology, “which has the potential to not only reduce our carbon footprint, but also realize cost savings that will allow us to keep prices low for consumers.”

Others, such as Canadian grocer Loblaw (25 trucks) and Canadian logistics provider Bison Transport (number unknown) have preordered Tesla trucks, reaffirming international demand. Also, NFI, a supply chain provider based in New Jersey that specializes in port services, has preordered an undisclosed number of trucks.

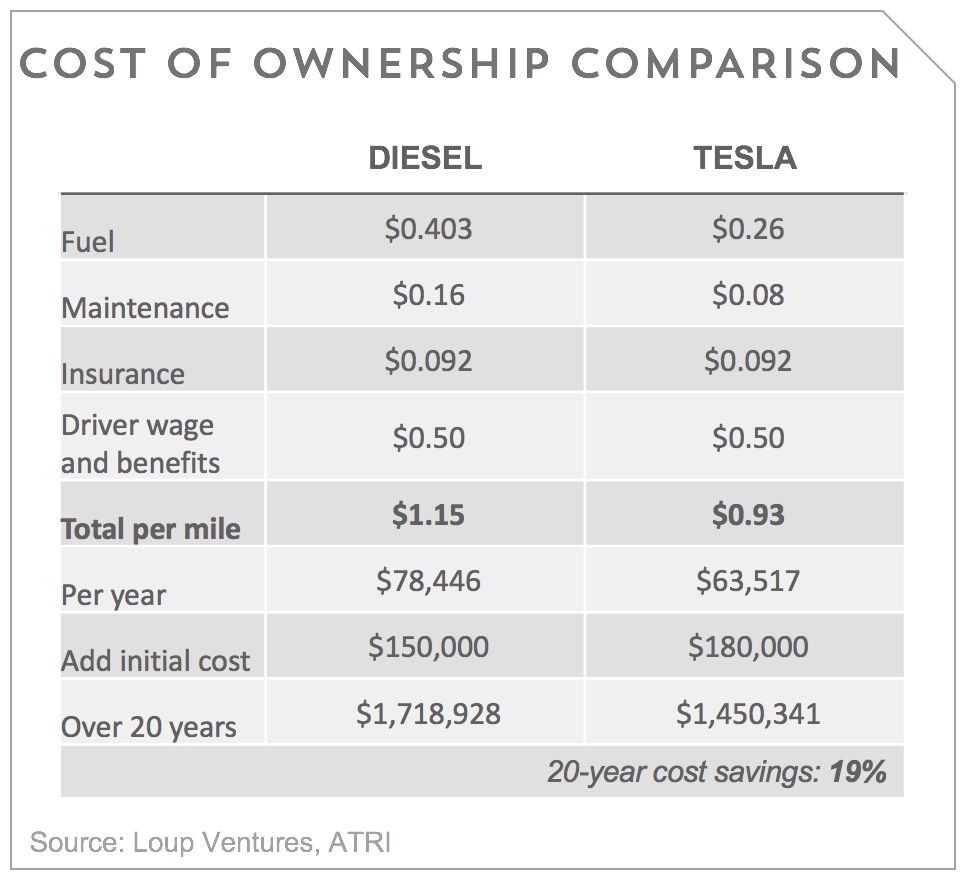

The case for buying one. Cost savings, primarily. As Musk laid out on a slide seen below, the fuel and performance savings have the potential to make a significant impact over time. In this case, Tesla suggests a 17% lower per mile cost of operation, and once platooning is implemented, the cost savings could be 47% less than a diesel truck. Tesla says on the new Semi tab of their website, “electric energy costs are half those of diesel. With fewer systems to maintain, the Tesla Semi provides $200,000+ in fuel savings and a two-year payback period.”

We did our own back of the envelope calculation with these numbers in mind, as well as some input from the American Transportation Research Institute and came up with a similar cost savings over a 20-year timespan. While we believe it will take longer than two years, fuel and maintenance savings will more than recuperate the incremental cost of the Semi over its service life. As Bob Lutz says in a CNBC interview, “these are people that operate by spreadsheets, and if you show them lower operating costs, then they’ll be interested.”

Aside from per mile cost savings, the Tesla Semi, via its improvement on many key issues with trucks today, may help remedy another problem in the industry – turnover. There is a massive shortage of truck drivers, some companies face turnover rates north of 90%, and driver recruitment and retention is a major cost that is not factored in on a per mile basis. The Tesla Semi may ease the burden with a better and safer driver experience. Some of the truck’s features include:

- Enhanced Autopilot

- Interior built around the driver with a centered seat, dual monitors, better visibility, and enough room to stand in the cabin

- Predictive maintenance for fleet management

- Windshield made of impact resistant glass

- Independent electric motors that will not allow the truck to jackknife by adjusting torque automatically

- Brake pads that won’t need replacing because the kinetic energy that would usually wear them out is harnessed to recharge the battery

- Low center of gravity from battery pack prevents rollovers

Hurry up and wait. Despite the excitement and speculation about what (or if) Tesla’s Semi will do to the industry, their focus for the foreseeable future remains ramping up Model 3 production. This is a do or die hurdle – neither the Semi, nor the new Roadster will see the light of day until it is accomplished, so our optimism surrounding the trucking opportunity will have to wait.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.