It's all about margins

Margins are particularly important to the TSLA investment case given they’re at the front line of the investment debate: Is Tesla a car company or a tech company?

Expectations for Dec-23 are for margins ex-credits to improve slightly to 17.1%. I see risk to this metric given the ramp in Cybertruck. Overall, I believe margins will end the quarter at 16.7%, compared to 16.3% in the Sep-23 quarter. While this would be below the Street, I see it as a directional positive because it would mark the end of four consecutive quarters of declining margins. As a point of reference, margins peaked 7 quarters ago at 29%, and even with the decline, Tesla still holds a slight advantage over other carmakers at 10-14% gross margin.

Looking forward to the earnings call and CFO Vaibhav Taneja’s commentary about margins in 2024, I expect the take-away to be to expect margins to remain stable during the year. This may cause a slight downward adjustment for the Street’s full-year ~19% auto margin ex-credit assumption, given I believe the year will end in the 18-19% range. This is based on a belief that Tesla will be in investment mode in the first half of the year with the ramp in production of Cybertruck along with the Model 3 refresh that will likely dampen margins. In the second half of the year, margins should begin to improve with a step down in retooling costs and an increase in production and deliveries. Putting those two forces together yields gross margin ex-credits for the full year between 17-18%, slightly below the current consensus of about 18.5%.

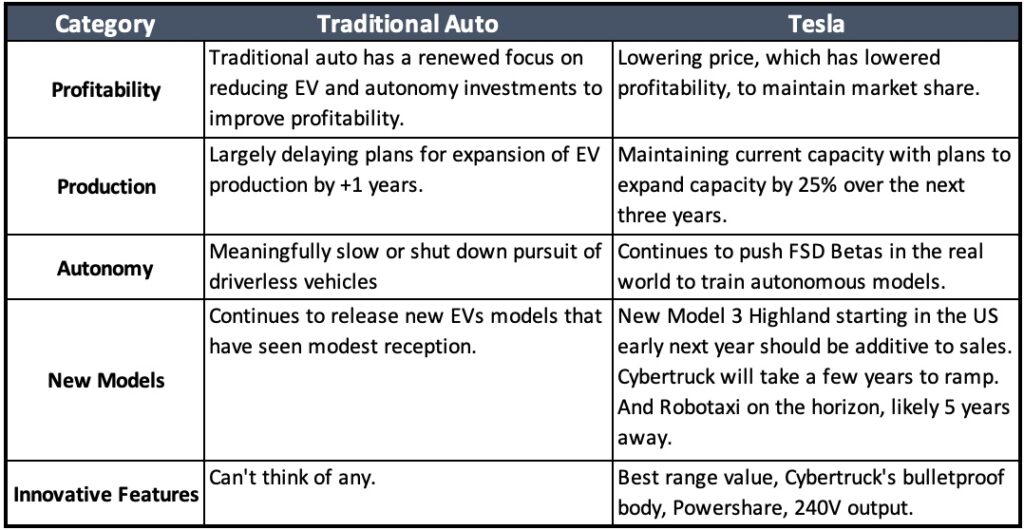

Long term, I believe Tesla will expand operating margins to 25% or greater, while I expect traditional carmakers’ margins to compress over the next 10 years as they feel the financial impact of the transition to EVs.