Simple, Effective Hedge Funds

Arthur Jones was a sociologist who studied at the Marxist Workers School in Berlin and later became a writer for Fortune magazine. At the age of 48, Jones created the world’s first hedge fund.

It’s often industry outsiders who create profound innovations. Outsider innovations tend to rely on simple, first principles insights dictated by basic knowledge rather than complex insights that come with experience. Jones’s hedge fund concept was simple and effective — balance long positions with shorts to neutralize broader market moves and separate pure stock picking alpha.

While many of today’s hedge funds often employ Jones’ simple long/short structure, many modern funds also add other instruments like derivatives, private equity, and other tools in an attempt to add alpha. Simplicity rarely sticks in the investment world, even though simplicity is commonly the most effective strategy. Complexity is easier to sell in investments. It makes you look smart, and everyone wants smart people managing their money with complex strategies that emanate an aura of potential outperformance.

If you want to do something hard, make it complex. If you want to do something that works, make it simple. Hedge funds are no exception.

Julian Robertson once described his strategy at Tiger Management as “invest in the 200 best companies in the world and short the 200 worst.” He added that if his simple system didn’t work, “You really ought to get out of the business.”

Robertson compounded Tiger at 31.5% annually between 1980-2000 when he shut down the fund during the Dotcom boom.

Buy the best. Short the worst.

Simple. Effective. Timeless.

AI-Powered Long/Short

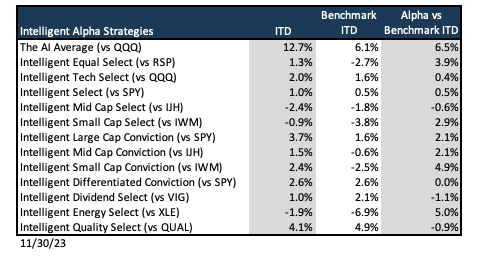

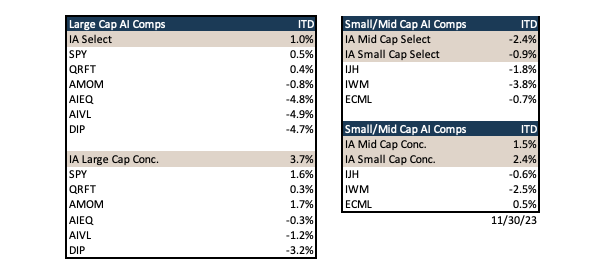

I’ve been using generative AI to create Intelligent Alpha investment strategies since the summer, and the results have been impressive. ~65% of the 30+ strategies I track are beating benchmarks, many by 200-500 bps.

The core philosophy of Intelligent Alpha is to combine two things that rarely go together — simplicity + AI. Instead of billions of noisy data points that most AI-powered investment strategies use, I instill the philosophies of the world’s great investors with curated data. Charlie Munger (RIP) wouldn’t consider social media opinions, technical signals, and random news when making investments, so why should we think an AI should? Because it can?

Most AI strategies try to incorporate too much useless data. As a result, they trade too much and invest too little. So, too, do many modern hedge fund managers. They incorporate noisy data because they think it holds a signal to outperformance. They try to pick stocks they think will go up, whether they’re good companies or not, and short companies they think should go down, whether they’re bad companies or not. They don’t seem to live by Julian Robertson’s simple approach.

The Intelligent Long/Short strategy does follow Robertson. It buys the best and shorts the worst.

We’ve been testing the long/short strategy for two months at Deepwater. The portfolio focuses on large cap US equities, holds 30 long positions and 30 shorts, and targets roughly 50% net long exposure.

Inception to date, the AI-powered hedge fund is up 350 bps vs the BarclayHedge Long/Short Equity Index up 70 bps.

Perhaps we shouldn’t be surprised at this point, but simplicity is working. Again.

The Best vs the Worst

Programming Robertson’s simple philosophy of buying the best and shorting the worst begs an important question when training my AI investment committee: What makes a company the best vs the worst?

The best companies have strong products that customers can’t live without and can’t get anywhere else. Fundamentally, this results in persistent revenue and earnings growth and high returns on invested capital. At a high enough price, stocks of the best companies may fail in the short term, but they’re destined to drive the market in the long term.

The worst companies have weak, easily substituted products that will result in static to declining long-term business prospects. Fundamentally, this means persistently challenged revenue and earnings growth and low returns on invested capital. At a low enough price, stocks of the worst companies may work in the short term, but they’re destined to trail the market in the long term.

Whenever I build an intelligent portfolio with AI, I can’t help but judge it. Sometimes the AI committee puts a stock in the portfolio that inspires me. Sometimes the committee selects a stock that makes me cringe.

For the Robertson-inspired long/short portfolio, I like the AI committee’s long on DXCM and short on INTC. Each fit the definition of best and worst well. I cringe at the committee’s long on CHTR and short on MDB for the opposite reason — they seem in opposition to the spirit of best and worst.

Building any intelligent system is an iterative process. The first iteration of my long/short strategy seems to pick shorts more on valuation and less on what I think of as business quality. While I try to interfere minimally with how my AI investment committee picks stocks, I plan on refining this outcome. It doesn’t follow the mandate of shorting the worst companies.

It makes sense to avoid shorting expensive high growth, high quality companies on a mere valuation call. Those stocks can defy gravity longer than you can stand, and they’re more likely to rip your face off than poor quality companies that trade at some modestly elevated valuation. There may be a time and place to short expensive high growth, high quality stocks (see 2022), but that’s the exception to the rule.

Listen to Julian: Short the worst, not the most expensive.

Where the Investment World is Going

Using AI to pick stocks has created a few strong beliefs:

- Simplicity will win in AI-powered investing. The longer Intelligent Alpha strategies perform well against benchmarks, the harder it is to think the outperformance is an accident. It’s not. Intelligent Alpha wins for the same reason great investors win: It optimizes for owning the best companies and tunes out the distracting noise that drives so much human and machine activity in markets. To wit, it’s also not an accident that Intelligent Alpha is beating other AI-powered ETFs:

- AI will only become a better investor from here. My experience with Intelligent Alpha convinces me that AI “understands” the task of investing. AI’s understanding is not the same as human understanding, but it does understand. Just as today’s iPhone 15 makes the original iPhone look like a dusty relic, so too will AI a few years from now. AI will generate an even more powerful understanding of the investing task, although since simplicity wins, greater understanding will only extend AI’s existing lead given results so far.

- Humans won’t be doing fundamental stock picking at scale in 20-30 years. If AI reaches its full potential, it’s hard to see why humans would continue to pick stocks in the future. AI will provide many different styles and investing philosophies to the market that replace the dynamism of human market participation. Humans will be pushed even more toward private equity given the illiquidity and relationships that separate that asset class from public markets. The other place humans might continue to play is in bubbles. Bubbles are a psychosocial phenomenon. Envy and greed will drive humans toward individual stock picking when markets get crazy. Smart humans will play bubbles to get in and out in ways that AI may not be able to. Most humans will ride the bubble to the bottom as is so often the case.

On the topic of bubbles, Robertson famously closed Tiger Management in 2000 at the peak of the Dotcom boom. His fund has underperformed for a period, and the brain damage was no longer worth it to him. Robertson was fabulously wealthy. He even once said he wished he shut the fund down two years earlier.

Of course, if Robertson had kept Tiger going through the bust of 2000, Tiger would have had incredible performance because it was short the sort of stocks that ended up losing 50%+ of their value

Therein lies another advantage of machines vs man: The machine doesn’t get rich and happy, nor does it feel the stress of underperformance. A machine programmed with the right investment philosophy can ride out tough periods and deliver alpha over the long run. Simple as that.