European and South Korean car makers take issue with the IRA

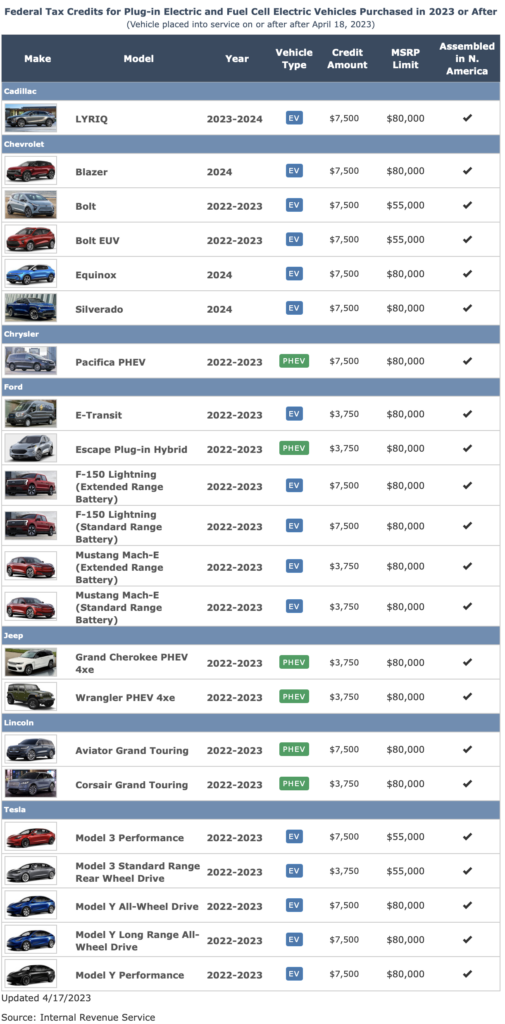

The IRA was signed into law in August of 2022. One component of the legislation was bringing back the $7,500 EV tax credit to increase EV adoption and make the US electrification supply chain less reliant on China. The goal was to incentivize car makers to do final assembly in the US and increase demand for battery components and critical battery mineral sourcing in the US.

In November, the 27 EU nations agreed that the incentives posed by the IRA could damage their economies by reducing the price of US-made EVs by an average of 12%, making it harder for them to compete. That concern was echoed by South Korea.

Last December, I wrote that a potential tweak was in store for the IRA related to expanding the list of EVs eligible for the $7,500 US tax credit to smooth over the tensions with European trading partners.

On April 17th, the DOE announced changes that make it easier for car makers to qualify for EV tax credits by adding Japan and Korea to countries that can supply the anode and cathodes to battery cells assembled in the US. Previously a car maker needed to source a percentage of the battery’s anode and cathode in the US to have their vehicles qualify for the $7,500 credit.