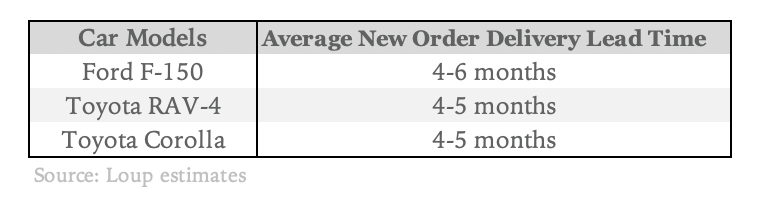

It’s no surprise that chip and component shortages have extended new car delivery lead times. On top of that, the uptick in consumer spending has compounded delays. A view of when the automotive industry will reach supply demand equilibrium should also help inform investors when the broader consumer hard good markets will reach equilibrium. Tracking this dynamic should give a sense of when transitory inflation has evolved into sustained inflation. To help inform our view, we recently contacted 50 US car dealerships and polled sales people on new car delivery times for three popular models, the Ford F-150, Toyota RAV-4, and Toyota Corolla. We also checked on Model 3 and Model Y delivery times. We found lead times of 4-6 months for the first group of cars, and 2-3 months for Teslas. Before the pandemic, lead times would have been around a month and a half.

The Power of easy comps

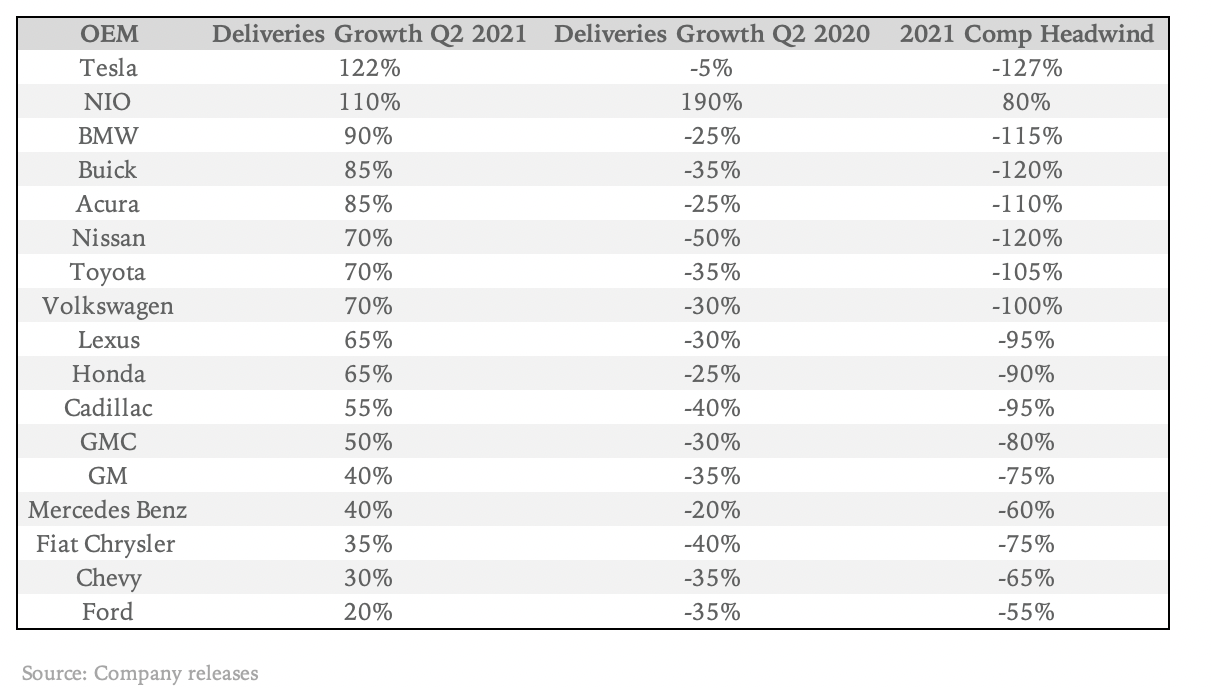

Despite tight inventory, the automotive sector reported impressive growth for the June quarter. The 17 automakers that report, grew deliveries in the most recent quarter by 65% on average, compared to down 18% in June of 202o. This of course was on the rails of easy comps given June of 2020 factored in the full weight of shutdowns. If it were not for the chip shortage, we could expect the June 2021 delivery growth numbers to be even higher.

The EV trend continues

EV companies including Tesla and NIO lead the pack with June 2021 growth above 110%, compared to the other 15 OEMs that on average reported deliveries up 58%. It’s worth noting, some companies are surviving on their current inventories while others such as Ford are stretched extremely thin. The most popular car in the US is the F-150, which we found almost impossible to find in stock.