The Great Reshuffling, which has its roots in the pandemic, is changing how and where people live and work, which in turn is changing where companies do business. It’s also impacting how brands and retailers do site selection for brick and mortar, which has created an opportunity for companies like Enjoy. The reason is because Enjoy provides retailers location flexibility and scalability for demand. Enjoy is going public via SPAC this summer. Loup is an investor in Enjoy.

The Great Reshuffling is creating two structural headwinds for retailers:

Headwind 1: Location flexibility

For retailers, the Great Reshuffling has made retail site selection more difficult because predicting future traffic patterns is more difficult. Today, there’s a movement away from urban areas to suburban and rural areas. But who’s to say whether in 5 years cities regain their appeal as pandemic scarring fades, and walkability is once again given a premium over space? Locations can come and go out of favor, and few retailers are willing to take the risk of building a physical storefront amid uncertainty about where consumers will live and how they will shop. And yet, premium retailers need to provide an “in-store like” experience (face-to-face retail) because it’s an important differentiator and something their customers want.

Headwind 2: Scaling for Demand

Another challenge for brands and premium retailers is finding a scaleable, cost effective approach to meet demand. They don’t want to overbuild off or online retail given the associated cost. Conversely, under-building may result in missed sales. Compounding the challenge is uncertainty as to how exactly the Great Reshuffling will play out. We don’t know the answer, and do know it will likely take 5-10 years to fully unfold because major life decisions are usually not made in haste. This means location and demand uncertainty for retailers will linger.

Thoughts on Enjoy valuation

Enjoy is expected to go public with an enterprise value of about $1.2B. The company will become public in an environment that has been favorable for retailers that have benefitted from the return to normal and consumer pent-up demand trade. In the end, we see fair valuation two years from now closer to $2.8B.

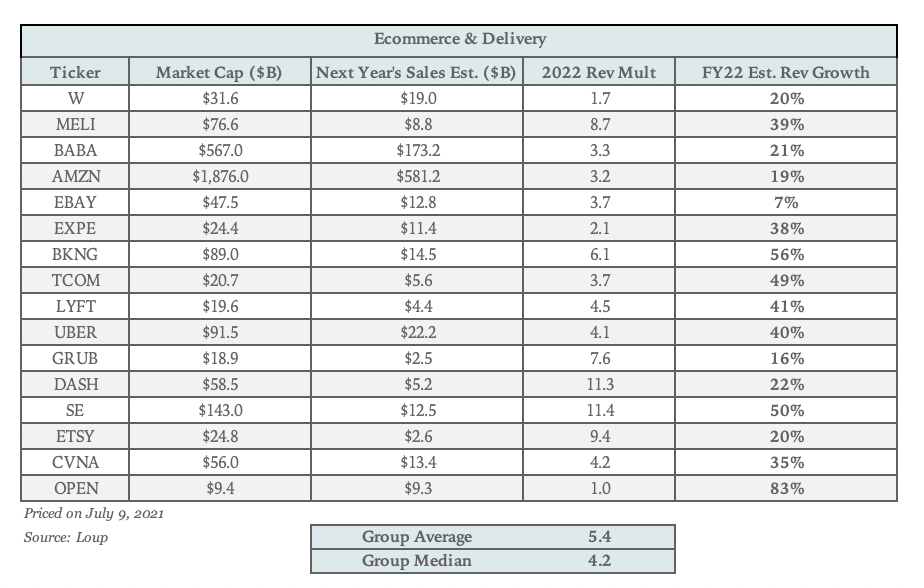

In our piece Enjoy is a Pure Play on Experiential Retail at Home, we identify three potential comp groups for Enjoy: brick-and-mortar retailers, ecommerce and delivery, and premium brand retailers. We think the most appropriate comp is the ecommerce and delivery group, given its tech focus. In May, this group’s 2022 sales multiple was 5.6. Today that group is trading at 5.4, with the downtick driven by investor concerns regarding interest rates and their impact on broader tech.

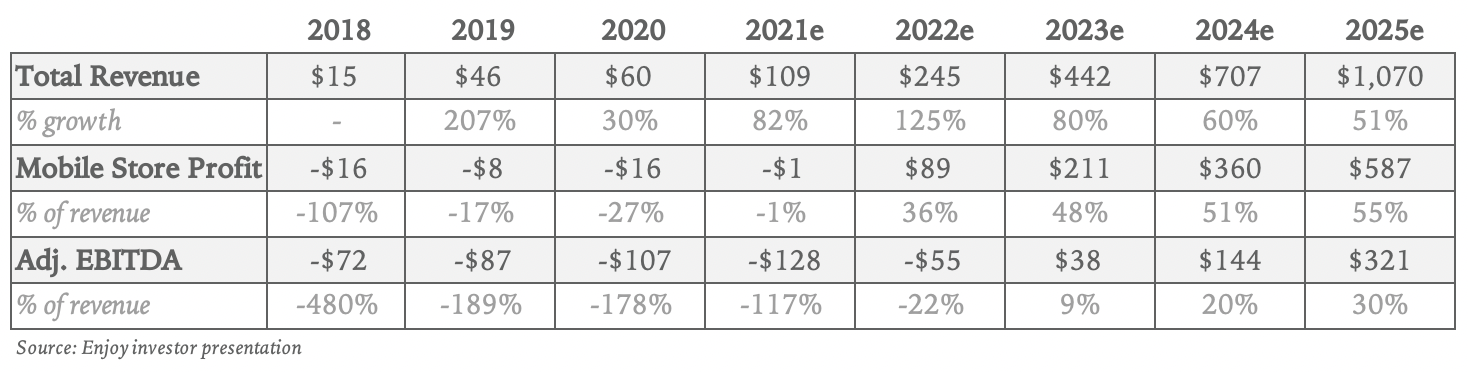

Applying a 5.4x multiple to Enjoy’s 2022 sales estimates implies a current valuation of $1.3B. Looking two years ahead, we believe Enjoy will grow revenue in line with its projections (see chart below), and we anticipate the comp group’s multiple will decline slightly, given the segment’s overall revenue will likely decline over that time. Applying a 4.0x multiple on projected 2024 revenues of $707m yields a $2.8B valuation.