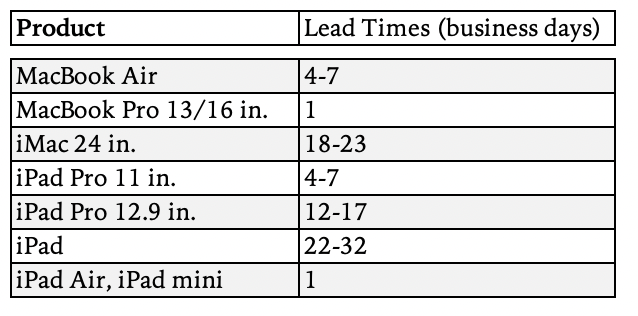

Demand for Mac and iPad over the past 12 months has been strong, propelled by the digital transformation and work- and learn-from-anywhere tailwind. On Apple’s March earnings call, management guided to a $3-4B combined headwind for these two segments in the June quarter due to supply constraints, noting, “we expect to be supply gated, not demand-gated.” Our spot check of Apple lead times suggest the company was right, and that demand is still outpacing supply as we exit the June quarter. Net net, we see the positive demand tailwind as much stronger and more sustainable than any supply headwinds. Estimated delivery dates for some iPad and Mac models are more than a month out:

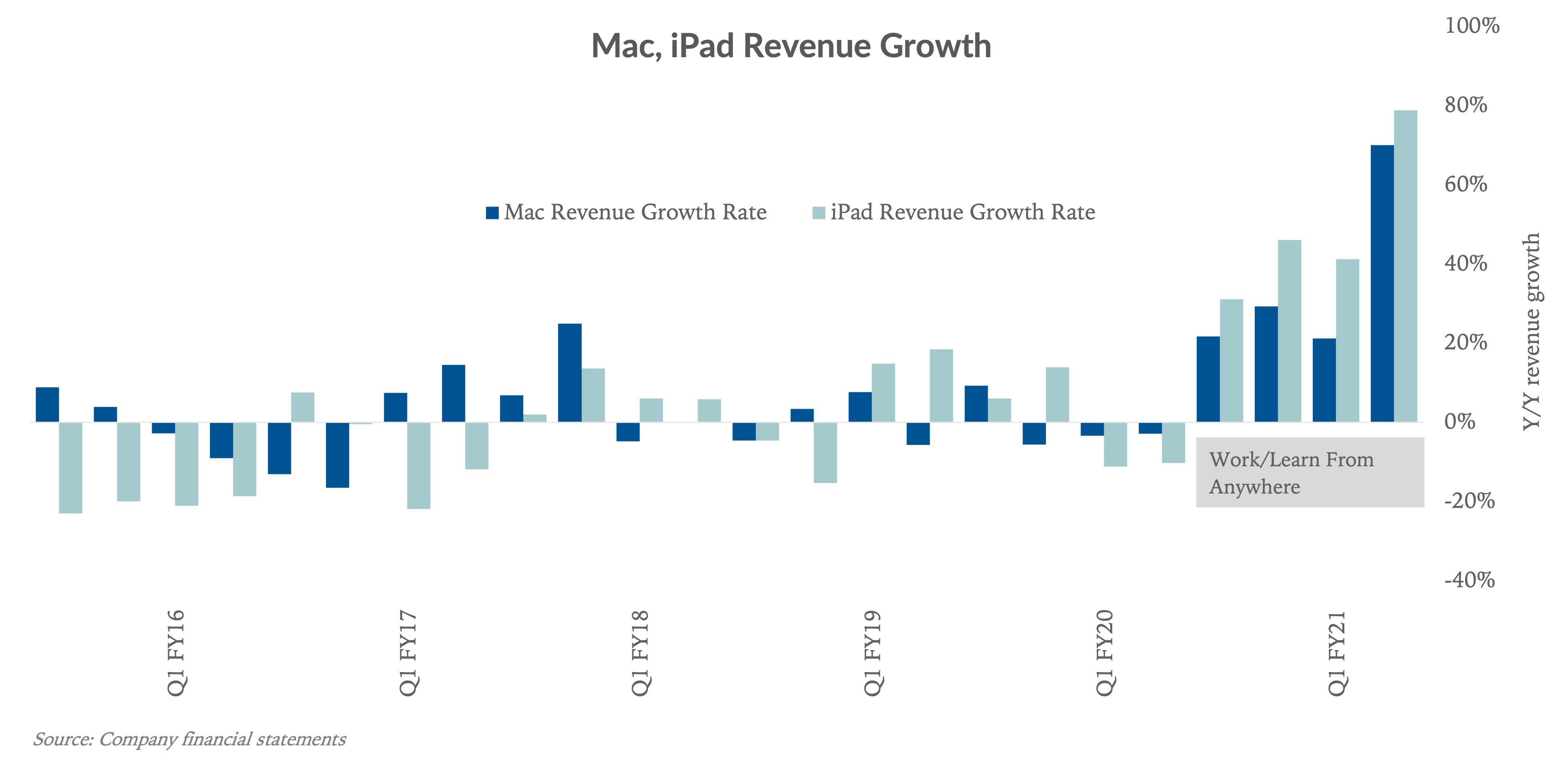

While interpreting lead times is more art than science, we’ve observed that during periods of supply demand equilibrium, lead times are typically less than 2 business days. Keep in mind, June is typically the slowest quarter for Apple, so if there was ever a quarter for the company to catch up supply with demand, it’d be this one. Taking a step back, many thought the March quarter was as good as it gets for Apple, with 70% and 79% growth for Mac and iPad, respectively, and 54% overall revenue growth. In our view, things are going to get even better for Apple, driven by an accelerating digital transformation that we cannot yet fully comprehend.

Mac and iPad growth will continue

On the negative side, supply constraints will probably take a few more months to iron out, likely modestly tempering Mac and iPad results in the September quarter. On the positive front, we believe elevated demand will be longer-lasting, thanks to the work- and learn-from-anywhere tailwind, along with the ongoing transition of the Mac lineup to M1 chips. As a reminder, the MacBook Pro 16”, iMac 27” and Mac Pro are expected to transition to M1 chips over the next twelve to eighteen months. We estimate these models represent around 30% of Mac revenue.

Regarding the digital transformation, we’re still in the early stages of a new hybrid paradigm, with businesses, schools, and consumers electing to outfit and upgrade their hardware. Based on this, we believe Mac and iPad can both grow revenue 8%, 7%, 6%, and 4% in FY22, FY23, FY24, and FY25, respectively, which would be above consensus estimates. For context, in the five years leading up to the pandemic, Mac and iPad were generally flat businesses:

A note on iPhone

In terms of the iPhone, management commented on the last earnings call that supply-demand balance had been achieved during the March quarter. This appears to be holding steady as we exit the June quarter, with lead times across the iPhone family at 1 business day.