Instacart: A Technology Company

When I was a sell-side analyst, we used to joke that every IPO was a tech company because it seemed everyone wanted to tell a story about how they uniquely use technology to command a higher multiple. Look no further than the recent Oddity IPO.

Oddity makes consumer beauty products through a tech-heavy process that leverages data and machine learning to create and market product. The company’s corporate name is Oddity Tech Ltd. In its S1, Oddity states:

We are a technology company seeking to reinvent every aspect of a massive industry. Our tech team is the largest team within our company today and comprises over 40% of our headcount. We invest heavily in data science, machine learning, and computer vision, and we have an evergreen commitment to exploring and investing in emerging technologies. Our technology innovations, when combined with our world-class physical product range and compelling brands built to win online, aim to eliminate significant friction for customers and support a seamless end-to-end user experience.

Consumer-focused companies that push a technology angle always raise alarms for me. Consider the 2021 “tech” IPO of Olaplex, a shampoo company. From their S-1: “OLAPLEX is an innovative, science-enabled, technology-driven beauty company.”

Olaplex’s stock is down 87% from its $21 IPO price as of 8/29/23.

I don’t know much about Oddity. It may be a great business, but I do know this: Consumers don’t give a shit about technology. Consumers want products that work magically, where technology fades into the background. No amount of technology can save a company with products that don’t inspire consumers and deliver some experience they can’t get anywhere else.

Now Instacart pitches itself as a technology company.

From Instacart’s CEO letter in the S-1:

We believe the future of grocery won’t be about choosing between shopping online and in-store. Most of us are going to do both. So we want to create a truly omni-channel experience that brings the best of the online shopping experience to physical stores, and vice versa.

With the business of grocery changing so quickly, many retailers need a trusted partner to help them navigate this digital transformation so that they can drive success both online and in-store and serve their customers better — in all of the ways they choose to shop. It’s especially important because their competitors — from established tech platforms to new startup disruptors — are trying to lure customers away from traditional grocers. If the neighborhood grocer who has been serving their community for decades can’t find an edge, they may not be able to keep up.

That’s where we come in.

Instacart is a grocery technology company.

Should we believe it?

I believe it because Instacart’s primary customer is the grocery retailer, not the end consumer.

Another back on the sell side story: A company IR person once explained to me that the order in which they listed components of the business is how much each component contributed to results. Obvious in hindsight, but it’s a lesson that has stuck with me. The order of things in company reports and filings always tells us something.

Throughout the S1, Instacart lists its constituents in this order:

- Retailers — the 1,400 grocers Instacart serves like Aldi, Costco, and Kroger.

- Customers — the 7.7 million monthly shoppers who buy on Instacart.

- Brands — the 5,500 CPG manufacturers like Campbell’s, Nestle, and Pepsi that advertise on Instacart.

- Shoppers — the 600,000 gig economy workers that pick orders at retailers and deliver groceries to customers.

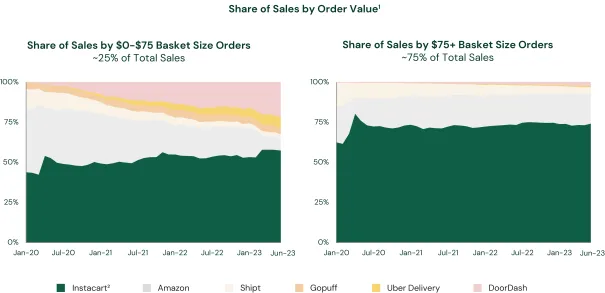

Instacart’s most important constituent is the retailer, and they know it. This may seem a minor point, but it’s important. There are a lot of great companies that deliver groceries. DoorDash, Uber, Walmart, Amazon. DoorDash is gaining share on smaller grocery orders, which makes sense as customers can tack small grocery needs onto other delivery orders with minimal additional cost.

What Instacart’s competitors don’t have is a technology solution built specifically for grocers that creates a deep relationship with those retailers.

The second strength Instacart lists in “Our Strengths” from the S-1:

We are investing more in technology custom-built for online grocery than any single grocer could on their own. Our machine learning algorithms process billions of data points each day to optimize a range of decisions and tasks, including basket building, merchandising, replacements, personalization, ads quality, demand forecasting, order fulfillment, shopper fleet mobilization, dispatching, and routing. Whenever a relevant new technology emerges, we assess how to adapt this technology for the specific needs of the grocery industry and make it available to our retail partners in short order — both online and in-store. We believe this incentivizes grocers to partner with Instacart, as they know that our technology will enable them to transform their businesses and enhance omni-channel customer experiences. Because we do not own inventory, we do not compete with our retail partners. We believe this combination puts us in a unique position to foster greater trust between grocers and Instacart, making us the preferred technology partner.

Technology for grocers is Instacart’s competitive advantage, and it’s particularly appealing to address a customer’s weekly grocery needs. Investors must believe in the value of that competitive advantage to believe in the company and ultimately the stock.