3 Predictions for AI-Powered Stock Picking

The quietest AI story of 2023: AI-powered stock portfolios trounced market benchmarks.

If you’ve been following The Deload, you know I’m obsessed with using AI to try to beat markets. My summer experiment to test ChatGPT vs the S&P 500 has grown into Intelligent Alpha which now tracks almost 40 AI-powered investment strategies.

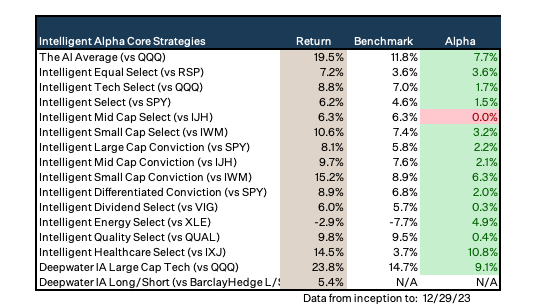

Intelligent Alpha won big in 2023:

- 83% of the AI-powered strategies were ahead of benchmarks as of the end of 2023.

- All but one of the 16 “core” strategies that address the largest segments of the indexed ETF market (e.g. large/mid/small cap US equities, tech, energy, etc.) beat benchmarks in 2023. The one core strategy that didn’t was flat vs its benchmark.

- Intelligent Alpha strategies are beating benchmarks by an average of 290 bps with a range of -650 bps to +1080. The median strategy is ahead by 220 bps.

A new year is a time for predictions, and I predict this: AI will get broadly recognized as a superior stock picker in 2024.

The recognition has already started.

Just last week, Eric Savitz at Barron’s penned an article that mentioned Intelligent Alpha’s progress. So too did Richard Lander at Citywire a few weeks earlier. (Thank you both).

Those stories are just the beginning of AI’s recognition as a stock picker. In 2024, three big things will bring attention to the prowess of AI-powered stock strategies:

- Intelligent Alpha will beat markets again.

- A human + AI fund will win big vs markets too.

- The first ETF powered by generative AI will launch in 2024.

1: Intelligent Alpha will beat markets again in 2024.

Repeating Intelligent Alpha’s 83% win rate vs markets in 2023 will be tough. The near 100% win rate of the core strategies will be even tougher.

Here’s my prediction: More than 50% of the Intelligent Alpha’s core strategies will perform ahead of benchmarks by 100 bps in 2024, and the median core strategy will be ahead of its benchmark by at least 100 bps.

A few things give me confidence in this prediction:

- The large cap and tech AI-powered strategies are largely underweight tech. If tech mean reverts, the AI-powered funds should be well positioned across other sectors. If tech doesn’t mean revert, the AI-powered strategies performed well in 2023 despite being underweight tech through that year too. I expect the underlying stock picking of the AIs to win the same in 2024 with or without a tailwind from mean reverting tech.

- Consensus seems to favor a rebound in small and mid cap stocks. If that happens, quality s/mid cap names should perform better than speculative names and also rans. Intelligent Alpha portfolios optimize for quality fundamental investments vs momentum or speculation, so the AI-powered portfolios should be well positioned no matter how s/mid cap names fare too.

- Generative AI will grow more capable as a tool in 2024. It may add the ability to do serious math which would be a potentially powerful addition to my existing process that’s performed so well.

What if Intelligent Alpha fails to broadly beat benchmarks in ‘24?

I don’t think that would change the future at all. I’m convinced that AI-powered investing is the future, and with all matters of conviction, there’s a healthy dose of faith involved. The only conviction that matters is in undiscovered truths, not mere matters of fact.

2024 will be the year of AI-powered stock picking, and if it’s not, it’s only because it’s delayed rather than derailed.

2: A Human + AI Fund Will Win Big vs Markets

AI-powered funds are the future of asset management, but humans can still play a role. I predict we’ll see an AI-powered fund that uses a human in the loop for certain decision making win big vs markets in 2024.

Human + AI investment strategies combine the power of AI as an unemotional stock picker with the knowledge of a human investor. Intelligent Alpha Human + AI strategies use AI to select stocks and weights with a human portfolio manager that chooses to use or ignore AI’s stock picks and determine when the portfolio should be reviewed by AI.

Human + AI is one of three kinds of AI-powered strategies I run with Intelligent Alpha. The other two are:

- Pure AI strategies where AI has complete portfolio discretion. AI picks stocks given certain criteria (e.g. large cap US equities) and weights the stocks based on its conviction. These strategies conduct portfolio review on scheduled intervals. Pure AI makes up the majority of Intelligent Alpha’s strategies including market cap, sector, geo, and factor products.

- AI informed strategies where AI identifies potential companies that fit within a strategic mandate (e.g. AI winners, AI hardware makers, GLP-1 beneficiaries), and then a rules based mechanism or committee does portfolio selection. Intelligent Alpha’s thematic strategies operate this way.

We run two Human + AI strategies at Deepwater powered by Intelligent Alpha: A concentrated large cap tech fund and a long/short equities fund. The large cap tech fund is ahead of the QQQ by 910 bps inception to date, and the long/short fund was ahead of its benchmark by about 200 bps as of the end of November (the last data I have).

Did the human add any alpha in these portfolios?

That’s the next experiment to be run. In 2024, I plan to test a Pure AI version of the concentrated large cap tech strategy vs the Human + AI version. I expect the human will add alpha to the strategy and prove an effective team against markets in 2024. However, as AI improves in capability over time, humans may be redundant as an investment partner in the longer term.

3: The first ETF powered by generative AI.

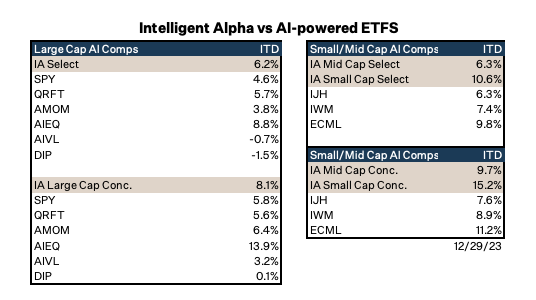

The market has several ETFs that use machine intelligence to pick stocks. There’s AIEQ powered by IBM Watson, WisdomTree’s AIVL, Euclidian’s EMCL, and BTD’s DIP. Qraft is an ETF firm built entirely to offer AI-powered ETFs. While these firms pioneered using machines as an investment tool before AI was AI, none of these firms offer ETFs built on generative AI platforms as far as I understand.

We will see the first generative AI-powered ETF in 2024. Maybe it will be with Intelligent Alpha, maybe someone else, but now is the time.

Intelligent Alpha strategies have largely outperformed comparable AI-powered ETFs since inception. I believe it’s because Intelligent Alpha uses foundation models that enable generative AI while other funds use more traditional machine learning and deep learning techniques.

There’s a huge difference between those approaches.

Foundation models are named such because they have a foundation of established knowledge. The reason ChatGPT can answer random questions from how to make ice cream to what will happen if you cut strings on balloons held by a girl is because GPT has a broad “understanding” of the world.

The models used in current AI ETFs are trained on specific quantitative aspects of investing with vast amounts of data. Those models do not leverage the same broad knowledge base of a foundation AI model. As such, models used in current AI-powered ETFs are built to understand narrow statistical patterns that appear to be paths to profit while foundation models can understand investing as a concept more like a human.

That’s why I use foundation models. I take the AI’s broad understanding of the world and gear it toward intelligent stock picking.

If my approach to using generative AI continues to yield effective results, why won’t everyone else do it? What’s the moat?

The moat is patience, which is both built into the Intelligent Alpha strategies and required to create them.

Sometimes getting AI to pick stocks is like working with a cranky 23 year old genius that just wants to be left alone. It finds every excuse to not do what you ask. Claude has been particularly fearful of violating copyright laws since the NYT sued OpenAI. Bard became almost unusable after the Gemini “upgrade,” although using Gemini outside of Bard has been quite effective.

Claude is recently paranoid about copyright issues. I wonder why…

So, yes. Other people can use generative AI to pick stocks if they can craft effective prompts, imbue the AI with the right philosophy as a stock picker, and patiently work through cantankerous AIs that make every stock picking session an adventure.

My bet is most firms would rather have the hard moat of data. Unfortunately most data is just noise that forms a protective barrier no one will care to cross.

Bonus: AI will create a multi-trillion dollar shift in assets

The AI-powered money management revolution is just beginning.

AI-powered investing will force a multi-trillion-dollar shift in equity asset management. Just as indexed ETFs garnered trillions in assets away from actively managed funds over the past two decades, AI-powered fund products will do the same to active and passive funds over the next few decades.

Why?

Because AI will prove to be able to consistently surpass benchmarks. Something few managers can do.

According to S&P’s SPIVA report, only 35% of active managers outperform the S&P 500 in a given year.

Not only do I think AI will beat markets in 2024. I think it will do it in ‘25, ‘26, ‘27. No, AI won’t win every year, but AI will win often enough, and by enough, to attract assets looking for consistent alpha that definitionally can’t come from indexes and is unreliable from humans.

The world’s largest ETF is State Street’s SPY. It tracks the S&P 500 and has nearly $500 billion in assets. SPY also happens to be the world’s first ETF, which launched in 1993.

We’ll look back in 2044 and reminisce about the AI-powered equivalent of the SPY that launched in 2024. It will have hundreds of billions of assets. Maybe more. And it will consistently beat the S&P 500.

If you’re not early, you’re late. It’s still so early for using AI to generate alpha. Now is the time to start. The future of investing is intelligent.