Written by guest authors Lindsay Boyajian, Product Marketing, and Zack Kadish, Professional Services at Conductor.

For the past few years, we’ve seen the buzz around AR and VR build. All the major players from Amazon to Apple to Snap have made investments in the space. Funding for VR and AR startups, according to TechCrunch, has amounted to $2.1 billion this year in at least 217 companies in the AR and VR space.

However, is it all just hype? Is consumer interest really growing? Which brands and publishers have the most market share?

This report examines organic search data from Conductor to realize insights into consumer behavior and brand market share. The Conductor Searchlight platform tracked thousands of the most relevant, high-volume search terms that consumers used to find products, services, and information in Q4 2017 related to AR and VR.

Search market share indicates which brands and publishers own the top positions in search results. This data is invaluable because search behavior is a strong indicator of consumer buying intent. It provides insight into what brands, products, and services consumers are interested in.

The insights in this report highlight trends in AR and VR that will influence growth and adoption in 2018. It has category breakdowns to provide a better understanding of who’s dominating by product category and purchase journey stage.

Is AR or VR winning?

For years, VR was the rising star, overshadowing its cousin AR. But the tides turned in 2016 when experts began hailing the potential of AR. In September 2016, Apple CEO Tim Cook said, “My own view is that augmented reality is the larger of the two [VR & AR], probably by far, because this gives the capability for both of us to sit and be very present talking to each other, but also have other things visually for both of us to see.”

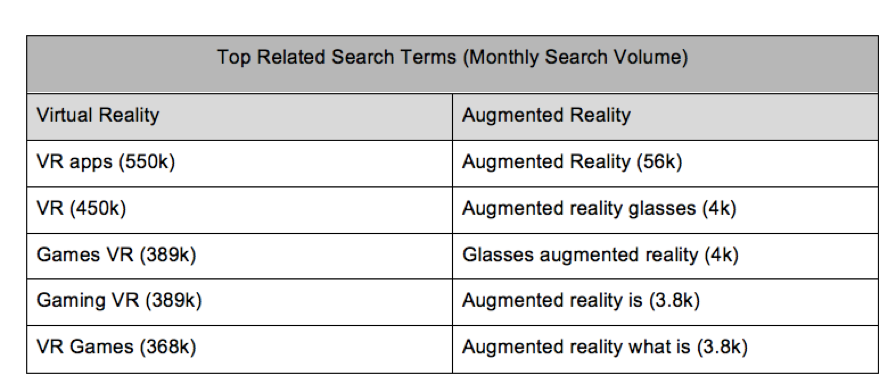

There are 30 times more searches related to virtual reality than augmented reality per month.

Despite the changing tides, VR is still leading among consumers. There are 30 times more searches related to virtual reality than augmented reality per month. Searches related to VR gaming are dominant, indicating that is where consumer interest lies today.

Search terms related to business applications of both VR and AR are negligible. For instance, “virtual reality in architecture” has a monthly search volume (MSV) of 320 and “augmented reality for healthcare” an MSV of 10. Neither technology is winning when it comes to owning the customer mind share for enterprise applications.

Which brands and publishers control organic market share?

Who owns market share for search terms related to VR & AR?

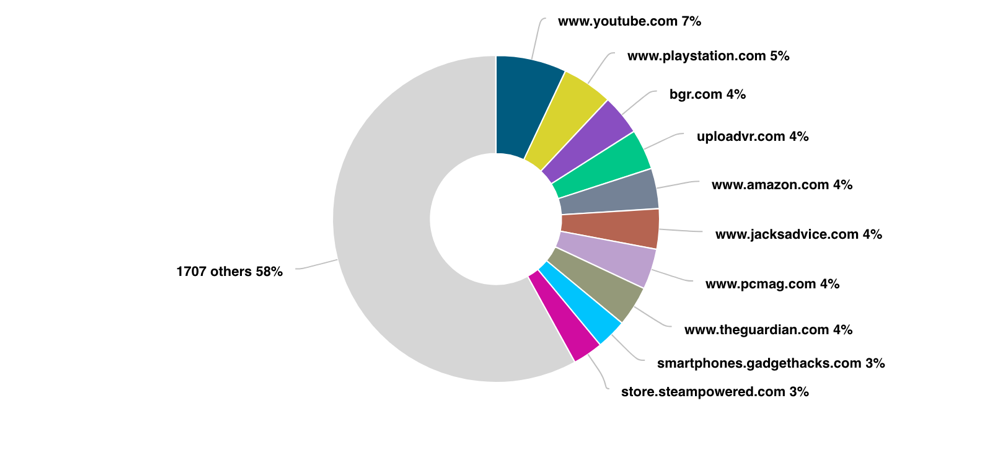

Who owns market share for search terms related to VR?

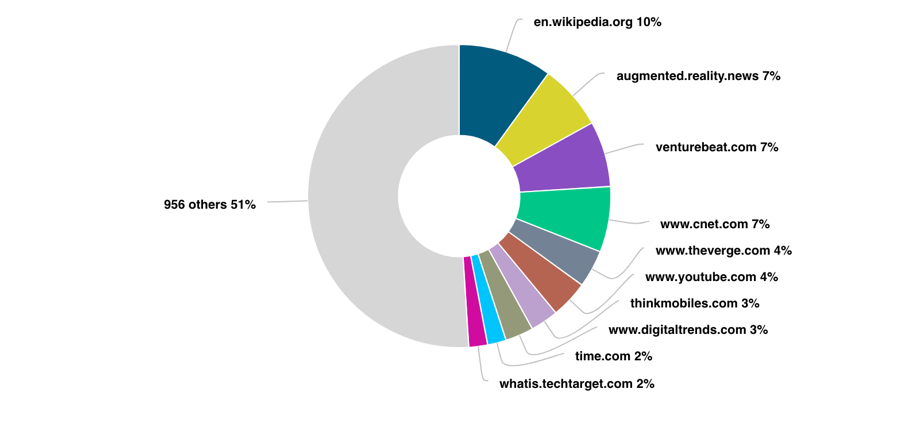

Who owns market share for search terms related to AR?

When we look at tracked searches related to virtual reality, publishers are dominant with some retailers, related to gaming (Playstation, Amazon, and Steam), capturing market share as well.

In comparison, publishers exclusively dominate tracked searches related to augmented reality. There are no retailers that have significant market share.

We also find that the majority of available market share is still unclaimed, represented by the large “other” slice. This indicates opportunity for late entrants to capture organic market share.

Are consumers ready to invest in AR & VR?

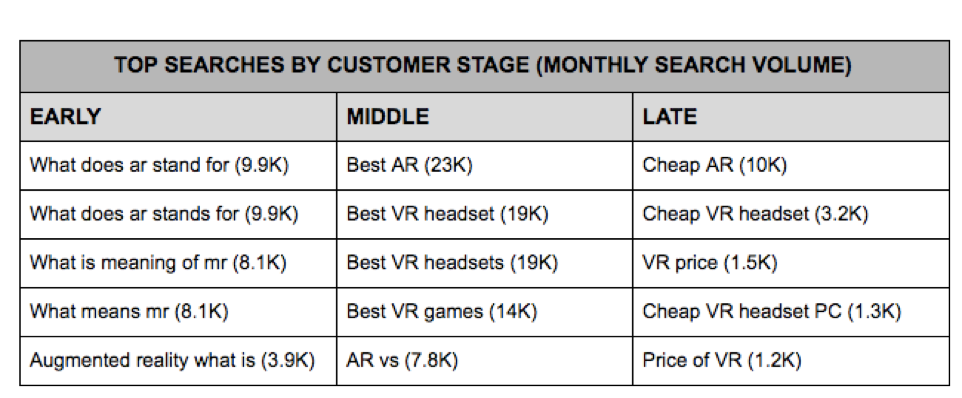

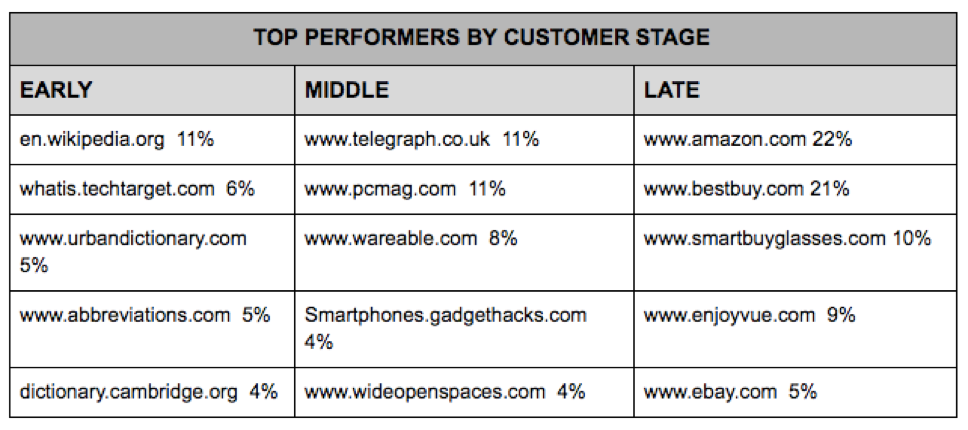

There are 5 times as many searches related to early stage intent compared to late stage. The searches are both more informational and comparative based (Early Stage and Middle Stage), rather than transactional (Late Stage). This suggests consumers are information gathering, rather than looking to buy a product or solution.

If we look at each technology individually, there are more transactional terms related to virtual reality than augmented reality. This indicates again that VR is winning when it comes to customer purchase intent.

What strategies can brands and publishers use to capture unclaimed market share?

Brands and publishers should consider optimizing their content for universal result types. 41% of all the tracked searches have video results. Given that most customers are searching for early stage content, brands and publishers should create early stage video content that answers questions like “how to” and “what is”.

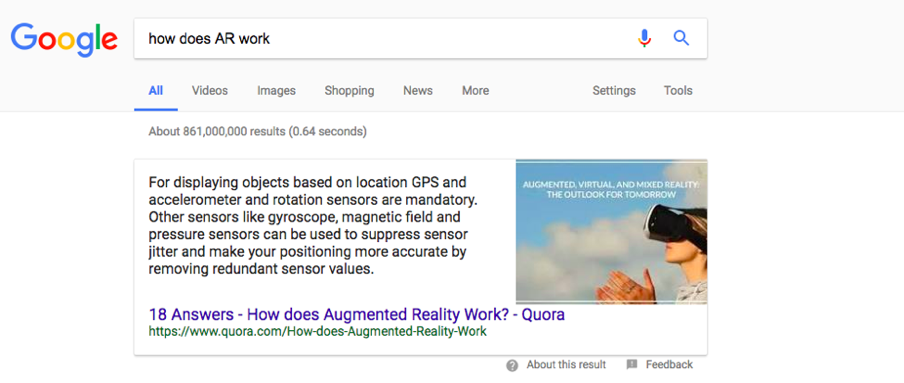

Similarly, 30% of all the tracked searches have Google answer boxes, suggesting brands and publishers should optimize their content for answer boxes. Answer boxes are the search result features that appear at the top of the organic results in a Google Search.

When it comes to what topics to write about, the search data suggests there is opportunity to create content around transactional (Late Stage) search terms. These queries have relatively high search volume, but not a lot of high quality content relating to these topics. Creating content answering transactional queries is recommended.

Finally, as we have seen, publishers outperform manufacturers and brands in most categories— suggesting that it’s an ideal entry point for other brands and retailers. By contributing content or advertising on publishers that have high visibility, brands can also make a play to win market share.

The organic search data in this report comes from Conductor. For more, follow Lindsay Boyajian and Zack Kadish on LinkedIn.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.