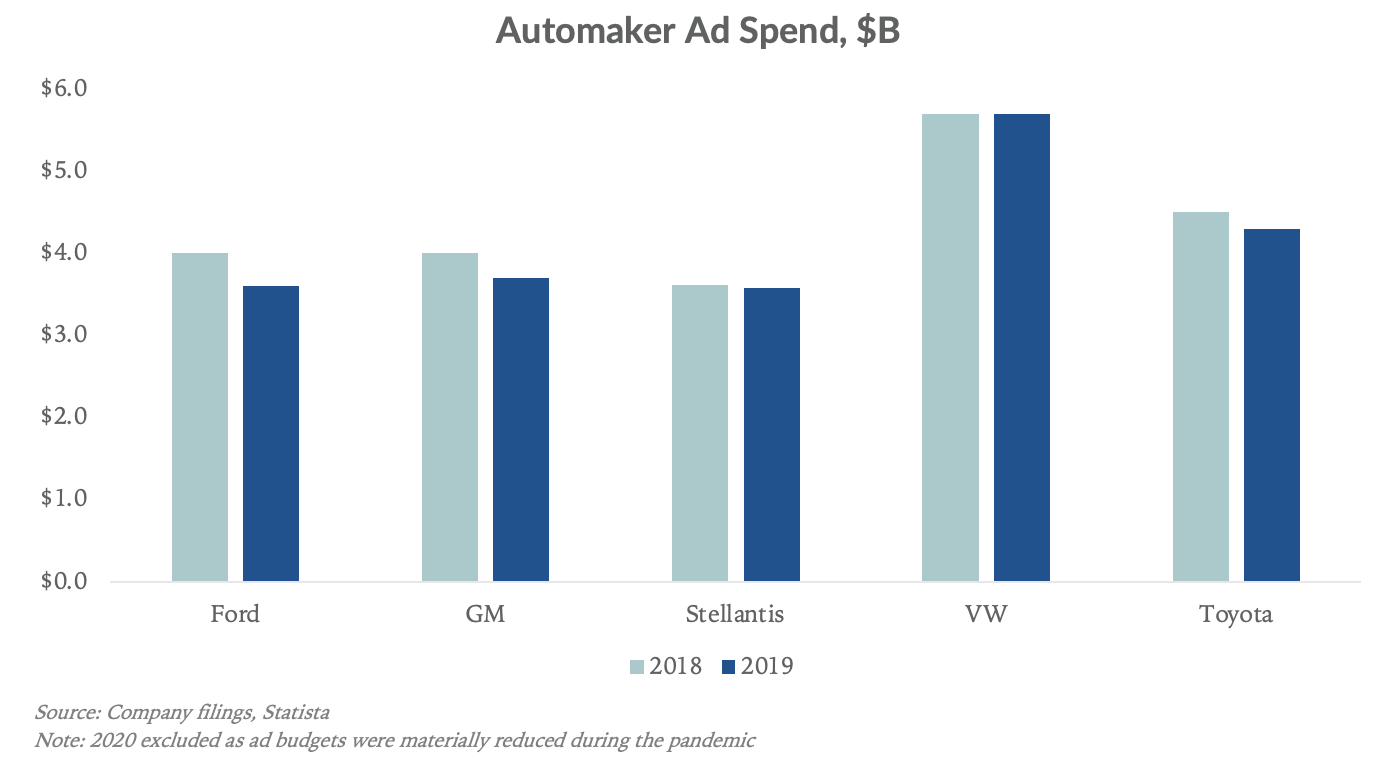

Automotive is one of the most aggressive industries when it comes to advertising. Tesla is unique among automakers in that it spends virtually nothing on advertising yet has outpaced the broader auto industry growth rate by 50% in both 2020 and 2019. In contrast, legacy automakers spend billions of dollars annually (around 2.5% of revenues), as shown in the graph below:

Typical automotive margins are slim, with net margins hovering around 5% for the industry. Tesla’s margins have been at parity or better over the past two quarters, with net margins of 10% and 4.5% in June and March, respectively. This advertising disparity, then, represents a competitive advantage for Tesla, and begs the question, what happens to Tesla’s net margin if and when they begin to advertise more?

Should Tesla advertise?

While Elon has an aversion to traditional advertising, he hinted this summer at informational advertising so that buyers better understand Tesla products. In other words, Musk is open to it. A starting point to estimating the timing and magnitude of any advertising spend starts with the reality that electric car buyers currently have Tesla in their consideration set. Additional advertising on a particular model won’t materially change that consideration percentage. Tesla is synonymous with electric and a brand that has sold itself to date thanks to a tech-focused customer base that has formed a passionate community around it.

Over time, however, more electric vehicles will enter the market and Tesla’s ownership of the EV theme will see some dilution. Our best guess is that competition becomes more measurable in the next couple years and that Tesla starts advertising meaningfully in 2025. The reason we don’t think advertising will be turned on sooner is because a company should presumably only advertise when it has enough supply to meet the expected demand advertising generates. In Tesla’s history, supply has been the rate limiting factor for growth, not demand. We believe this dynamic will continue for the next few years, and possibly longer, given manufacturing cars is difficult to scale and widespread demand for Tesla cars is still nascent, considering we are in the early innings of a secular shift from ICE vehicles to EVs.

Regarding how aggressive Tesla will be in advertising, we spoke to an ad executive with decades of experience in auto. He predicted modest advertising spend from Tesla over the next five years, with the company focusing its promotional dollars on sponsoring events for high-level branding. The comment caught our attention given it came from an industry expert who has built a career on selling auto advertising and believes it’s in Tesla’s best interest to approach such spending with a measured cadence.

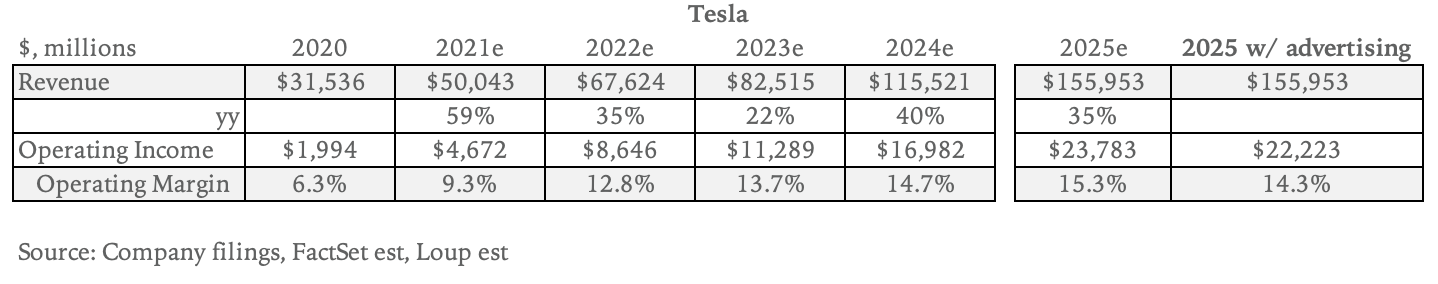

Estimating advertising’s impact on Tesla margins

As mentioned, the likely case is that Tesla’s advertising is a slow lift and ends up pacing below the auto industry’s levels. Take for example, GM and Ford, which spend about 2.5% of their total revenues on advertising. We’re estimating Tesla eventually gravitates to spending 1% of revenue ($1.5B) on advertising in 2025, which would equate to about $400 per vehicle. Backing this $1.5B in advertising expense out of operating income, operating margins would decrease from 15.3% to 14.3%.

In short, the impact to margins is measurable, yet moderate. That said, increasing advertising spend would likely weigh on shares of TSLA, given margins are a big piece of the Tesla story. In the end, we see Tesla’s advertising advantage as durable for the short to medium term.