Since February, a key question related to Apple has been: What would happen to the company if tensions between the US and China deteriorated? The simple answer, of course, is that it would be negative. The goal of this note is to answer the implicit, secondary question: How negative?

Before we dive in, it’s worth noting that US-China relations have been declining for the past five years. Throughout that period, Apple successfully navigated tech trade tariffs and strict pandemic protocols imposed by China. In spite of such headwinds, Apple’s revenue has grown from an average of 7% in (FY18-19) to 16% (FY20-22). If any company can pull off diversifying its supply chain without missing a beat, it’s Apple. But, back to the question at hand:

How negative will the impact of US-China relations be on Apple’s business?

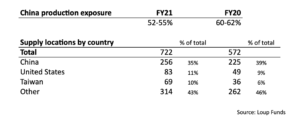

The company appears to recognize the inherent geopolitical risks of the supply chain and has been slowly shifting its production out of China. To gauge the speed of such diversification efforts, we reviewed the 2021 Supplier List (released in October 2021) which captures 98% of the company’s direct spend for manufacturing and products. We estimate that, in 2021, between 52-55% of Apple’s overall revenue was made in China, down from 60-62% in 2020. We expect that number will show a decline into the 45-50% range in 2022. Notably, of the 150 new manufacturing locations added in 2021, 79% are reportedly based outside of mainland China. This includes expansion within the United States (24), Taiwan (16), Singapore (9), Vietnam (8), Malaysia (8) and South Korea (7). While these appear to be modest supply chain shifts, we view this as a quick pace given the sheer size of revenue that comes from China-based manufacturing: ~$160B in FY21.

Apple’s China production & demand dynamic

- Production: From a high level, sales from Apple’s products segment account for 80% of overall revenue (reported number). Within this segment, based on the 2021 Supplier List, we estimate that 65-70% of FY21 revenue came from products that were made in China. In other words, we estimate that 52-55% of Apple’s FY21 total was made in China.

- Locations: Reviewing the supplier data from another lens, we looked at the array of supplier locations. As a percentage of locations, China facilities account for 35% of the total in 2021, down from 39% in 2020. As a point of comparison, the number of US-based locations increased to 11% from 9% during the same period. Of the 150 new locations in 2021, 79% are based outside of mainland China. This includes within the United States (24), Taiwan (16), Singapore (9), Vietnam (8), Malaysia (8), and South Korea (7).

- Demand: From the demand side, 19% of Apple’s FY22 revenue came from Greater China (reported number). We estimate that 70% of Greater China revenue comes from mainland China, or that ~13% of overall FY22 revenue comes from China. In FY21, we estimate that mainland China also accounted for 13% of overall revenue.

We believe the company is entering a transition of reducing its reliance on China that may take as long as a decade to achieve. Below is a list of supplier locations by country. Overall, the number of suppliers Apple reported increased to 722 in 2021, up from 572 in 2020.